Concepts of Economics and Business Models (Lesson 19)

Business Models – Market Forces

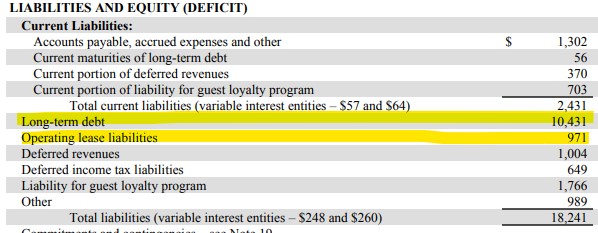

They currently pay an average interest rate of around 3.99% annually. Thus, the total interest to service this debt is about $430 million. Since much of the long-term debt exists in tranches (chunks) of notes with different maturity dates, any current increase in the interest rate will not have an instantaneous impact on the interest paid each year. However, when a note does expire and Hilton needs to refinance that note, it will be at a higher interest rate. Thus, over time, the aggregated interest paid will increase. Thus, assume the Federal Reserve increases interest rates a half a percent. It is conceivable that in about seven years, much of the outstanding balance of debt and leases will have matured and need to be replaced with higher-interest-bearing substitution notes/leases. At .5%, this will add another $60 million in interest paid to service this replacement debt. Thus, a simple macro-level force does indeed impact a single company over the long run. This is how value investors think related to these macro-level forces.

They currently pay an average interest rate of around 3.99% annually. Thus, the total interest to service this debt is about $430 million. Since much of the long-term debt exists in tranches (chunks) of notes with different maturity dates, any current increase in the interest rate will not have an instantaneous impact on the interest paid each year. However, when a note does expire and Hilton needs to refinance that note, it will be at a higher interest rate. Thus, over time, the aggregated interest paid will increase. Thus, assume the Federal Reserve increases interest rates a half a percent. It is conceivable that in about seven years, much of the outstanding balance of debt and leases will have matured and need to be replaced with higher-interest-bearing substitution notes/leases. At .5%, this will add another $60 million in interest paid to service this replacement debt. Thus, a simple macro-level force does indeed impact a single company over the long run. This is how value investors think related to these macro-level forces.- Choice – Every buyer and seller is given the choice to exchange their resources for a product or service. With value investing, choices are focused on the buy and sell points for investments.

- Opportunity Cost – When a transaction is completed, each party has lost an opportunity to sell it higher or buy it lower. It also refers to an alternative buy or sell that may have better risk or reward.

- Supply and Demand – Defined as the willingness to buy or sell a product/service.

- Market – Centers where suppliers and buyers meet to negotiate the equilibrium of value.

- Equilibrium – The final net exchange price between a willing buyer and seller.

- Price – The exchange rate between two parties.

- Competition – Many sellers and buyers are vying for resources.

- Macro/Micro – See above.

All eight of these will come into play as a value investor. Throughout these lessons, anytime one of these affects the principle or particular situation, it will be noted and identified to the member. The key is that it is so important to be on the alert for these economic concepts and their respective impact on a business’s financial model.

In addition to the impact economics plays on a financial model, there is another equally impactful aspect of value investing. This is the business model.

Value Investing – Business Model

In business, there are four distinct business models. Just about any business can be identified with one of the four. The following are the four types of business models:

- Low-Volume, Hi-Margin

- Hi-Volume, Hi-Margin

- Low-Volume, Low-Margin

- Hi-Volume, Low-Margin

No single model is the best nor the worst. Each works within their respective industries. In general, the models exist by default, and it is highly improbable that the model can move into another one of the types without changing the particular business sector/industry. An illustration is appropriate.

Wal-Mart is by far the most significant retail player in the worldwide market. They control more than 11% of all retail. They follow the Hi-Volume, Low-Margin model mostly by default. All of their competition uses the same model. It is impossible for Wal-Mart to shift its model to a Hi-Volume, Hi-Margin format. Their customer retention would fall dramatically if they raised their prices. But this model works well with the retail industry.

At the other corner sits Boeing. Here, it is low-volume with a high margin. Nobody is going to mass-produce huge airplanes; it takes several years from start to finish to construct an airplane. Quality control is a cornerstone of their business, and even a little error can cause huge repercussions. They could go to the low-volume low-margin section, but the overhead costs would cause the company to lose money. If this happens, they will go out of business. Out of necessity, this type of industry exists using this model.

Some businesses lean more towards one of the four but may have elements of two of the business models within their structure. It isn’t as if every business has to fall distinctly within one of these four types. But some bleeding over exists between two of the types is rare, not the rule.

The following sections explain the four types of business models and provide examples of businesses that use these models. In addition, this article elaborates on why the model is successful in the respective industries and that no single model is absolutely the best.

Low-Volume, High-Margin Business Activity

An extreme example of this type of business is a shipyard. Imagine how long it takes to build an aircraft carrier. In reality, it takes a little over 8 years from start to finish. Before laying the keel, there are several years of engineering and material requisition requirements to build the carrier efficiently. Then there is the construction period and the testing period before final delivery is made to the Navy. In effect, one product taking 8 years employing several thousand workers has to cover its share of the overhead and profit for the company. To do this, the final product may have hard costs of materials and labor that are half of the final price charged to the Navy. The bulk of the sales price has to cover all the equipment used, facility costs, general overhead, licensing (the government just doesn’t let anyone handle nuclear material), taxes, and a host of other costs to run a shipyard.

The following are more examples of low-volume, high-margin businesses:

Large Companies

- Aircraft manufacturing – Boeing

- Heavy Equipment manufacturing – Caterpillar, Komatsu, Hitachi & Volvo

- Military Equipment manufacturing

- Large Industrial/Commercial Contractors – Bechtel, Fluor & Kiewit

Small Business

- Engineering Design/Build Companies

- Metal Fabrication

- Marine Fabrication/Construction

- Home Construction/Remodelers/Renovators

Certain business attributes force the industry to exercise this model. They are:

- Significant initial capitalization (financial, perseverance, and knowledge);

- Almost all work is project-based and requires extended periods to complete;

- Highly complex interactions and resource management;

- Little competition

Notice that in this model, although it is a low-volume company, the term reflects the physical quantity, not the dollar value. Go back to the shipyard, an aircraft carrier is ONE item (low volume), but the sales price is nearly $8,000,000,000. That’s billions of dollars.

In a small business, it is really the same concept. For construction, it is ONE house, but it is an expensive item. It is the only way that a company can cover the indirect and overhead costs associated with running a construction company.

Now, on the flip side of this are industries that have high volume and high margins.

High-Volume, High-Margin Business Activities

This is the preferred type of business model to have due to the contribution value both extremes bring to the company. But these types of companies are not as common and often have significant capital barriers to start operations. Mostly they are in the professional services industry, such as law, accounting, engineering, and some medical specialties. In general, the margins are in the 40 to 50% range. This is mostly attributable to variable costs as the primary cost driver. The following are some other examples of these types of businesses:

- Coffee Retail/Coffee Supply

- Software Manufacturing

- Entertainment (Music Albums, Movies, Videos, Games)

- Hospitality Based Businesses (Hotels, Motels, Golf Courses, etc.)

An example of a large company with a high margin and a high volume is Apple. The iPhones cost less than $450 to manufacture and get to market. Retail prices run in excess of $1,000 for the device. Apple sells nearly 100 million units per year. This is a rare business model that has driven the stock price off the charts.

This type of business model is ideal. Typically, in these types of business models, the overhead and capitalization costs are higher than in other models. This is mostly attributable to the development of manufacturing facilities, distribution systems, and reliance on technology. In addition, competition is keen as others seeking to enter this type of business model seek the same high margins this model provides. In effect, lucrative returns create competition.

Another factor necessitating the high-margin requirements relates to higher-than-normal fixed costs. In many of these types of operations, fixed costs are recorded in the overhead section of the profit and loss report and therefore are not a function of the cost of sales.

High-Volume, Low-Margin Business Activities

This type of business model is traditionally seen in the retail and other consumer-based product businesses. The following is a list of businesses that use this model:

- Convenience Stores

- Gas Stations

- Grocery Stores

- Fast Food Restaurants

- Retail Outlets

- Transportation (Bus Lines, Distribution, Taxis, etc.)

- Service-Based Operations in More Discretionary Income Dependent Areas of Business

- Nail Salons

- Hair Salons

- Massage Parlors

An interesting business attribute is the low capitalization threshold to enter the market.

One last interesting fact about these types of businesses: this is the most common form of business in our consumer-based society. This reflects several business attributes:

- Easy entry for small business;

- Low capitalization barriers;

- Low knowledge thresholds;

- Many support systems;

- Limited government compliance requirements.

In this type of model, the gross margin in absolute dollars is a direct reflection of volume. Competition is keen. The best example of this is gas stations. In general, most gas retailers only have about an 18-cent contribution margin per gallon of gas sold. When the station down the street has its price 10 cents lower, he is trying to garner market share that week.

By the way, the number one company in the world uses this business model. You guessed it: Wal-Mart.

Based on this, you would think that it would be tough in your low-volume, low-margin business activity. Why would anyone get involved in that type of business model? Let’s find out.

Low-Volume, Low-Margin Business Activities

This one is the most interesting of all the business types. With low-volume, low-margin operations, the reader would wonder how on earth you would make a profit. Well, it turns out that there is another way to look at the equation. Less experienced business entrepreneurs always think in terms of margin as a percentage of sales. Experience and a little more sophistication teach us that it is really about the absolute dollars. Which would you rather have?

- Sales of 200 units in one day at an 18% margin or

- One unit at 13%?

Answer: It depends on the sales price. Assume that in A, the sales price is $7 per unit, which means that we have sales of $1,400, and the dollar contribution margin is $252 (this is your high-volume, low-margin business model). OR in B, the sales price is $14,000 with a contribution margin of 13% which is $1,820.

$1,820 is superior to $252. What industries fall into the type of model? Typically, your household goods and high-ticket items follow this model:

- Auto Retail

- RV Dealerships

- Marine Dealerships

- Appliance Sales

- Jewelry and Luxury Goods Retail

These industries typically have higher overhead costs and compliance-related costs. Since buyers of the product are rare, advertising becomes a significant portion of overhead costs. Just watch TV for half an hour, and about a 1/3 of your commercials relate to the local auto dealerships trying to convince you they are the best.

The negative attribute of this model is the higher-than-normal risk associated with acquiring customers. Any reduction in market share can wreak havoc with the financial profitability of the business.

Summary – Types of Business Models

Some businesses will fall in the marginal areas of one or more of the models above. A good example is a furniture retailer. In general, furniture has a high margin with low volume. But many furniture outlets try to shift their model towards higher volume with lower margins; thus, the constant bombardment of advertising from them with their endless sales.

Overall, each of the models described above works for particular industries. The sheer nature of the industry forces their hand into the respective model. When you think about your pool of investments, which model is utilized? Combining economic-wide forces with the respective business model allows the value investor and opportunity to appreciate the particular pool’s business characteristics, and it sets the stage for calculating intrinsic value and the corresponding buy/sell points. In the next lesson, value investors must understand the number one force affecting investments – the Federal Reserve. Act on Knowledge.