Phase II (Financial Analysis)

“The way to make money is to buy when blood is running in the streets” – John D. Rockefeller.

Without a doubt, there is one financial characteristic of all successful corporations and small businesses: stable earnings. Financial analysis is a set of tools, methods, processes, and ratios to assess an organization’s viability, stability, and various profitability points along the matrix of time and production. Financial analysis provides the analyst with the confidence and security that a good financial model presents. This phase of the membership program on this site gets into the nuts and bolts of the company’s financial information. The goal is to identify an industry’s financial model and the three to five critical pieces of information a value investor will use to determine how the market will set a security’s price. With this information in hand, a value investor will then set an intrinsic buy and sell value price. In effect, a range of value the market will bear for a security given the financial results of this organization, the industry standards the company adheres to, and finally, the impact the overall economy has on this company’s value.

Over a course of more than 80 lessons and supporting research, a member of this site’s value investment club will gain the confidence necessary to build their financial model for an industry they select as their own. There are lots of examples and illustrations included to support each of the lessons. In addition, this section of the membership program includes supporting spreadsheets, schedules, and worksheets to assist the member with building their model.

Throughout this phase, a master example is provided tied to the hospitality sector of our economy, specifically hotel/motel lodging operations. This phase will build this industry pool and provide the reader with not only an excellent industry pool for the site’s value investment fund, but also for their personal use inside their fund.

This phase of the program is divided into seven sections. The following identifies each section and provides an introduction to the student about the respective section:

- Concepts –

- Economy

- Industry Standards

- Financial Models

- Stable Growing Operations

- Financial Statements

- Balance Sheet

- Income Statement

- Retained Earnings Statement

- Cash Flows

- Notes to Financial Statements

- Ratios

- Key Performance Indicators

- Calculating Intrinsic Value

- Calculating Buy/Sell Points

- Building an Industry-Wide Model

Throughout these lessons, the student is introduced to the Hotel Industry and learns about that industry’s financial model. The key is to learn ‘What makes it tick?’ The result is a performance matrix along with a financial matrix that ultimately provides the secret of success. Lots of new terminology is introduced, including some peculiar terms only used in this industry. Each lesson builds on the prior lessons, and the result is an industry financial decision model with buy and sell points for all members of this particular pool. The members of this pool include:

- Marriott Hotels

- Hyatt Regency

- Hilton Hotels

- Wyndam Hotels

- Choice Hotels

- Intercontinental Hotels and Resorts

The primary business purpose is the traditional overnight lodging and extended stays. Those entities that have a strong gaming component were excluded from this particular pool in order to keep and maintain a high level of consistency related to operations and reporting.

The lessons, tutorials, webinars, white papers, and spreadsheets on this site are designed to teach these four principles. In addition, this site has over 600 supporting articles that augment the lessons and the program. It is effectively the best resource center available to learn about and implement a personal value investment fund. The annual goal is to achieve 22% plus returns.

You must be a member of this site’s Value Investing Club to access the respective lessons in Phase II – Financial Analysis and Phase III – Sophisticated Investing. In addition, membership entitles access to the respective investment pools and their associated financial models, along with emails of actual transactions for this site’s Value Investment Fund. To learn more, go to the Membership Page.

Industry Principles and Standards (Lesson 25)

How to Read a Balance Sheet – Simple Format

How to Read a Balance Sheet – Equity Section (Simple Format)

Gross, Operational and Net Profit (Differences)

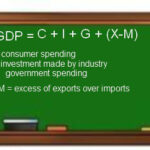

Gross Domestic Product (Lesson 21)

Elasticity in Economics (Lesson 22)

Economies of Scale (Lesson 24)

Economic Uncertainty (Lesson 23)

Definition of Contribution Margin

Current Liabilities Section of the Balance Sheet