Value Investment Fund – Six-Year Report 09/30/25

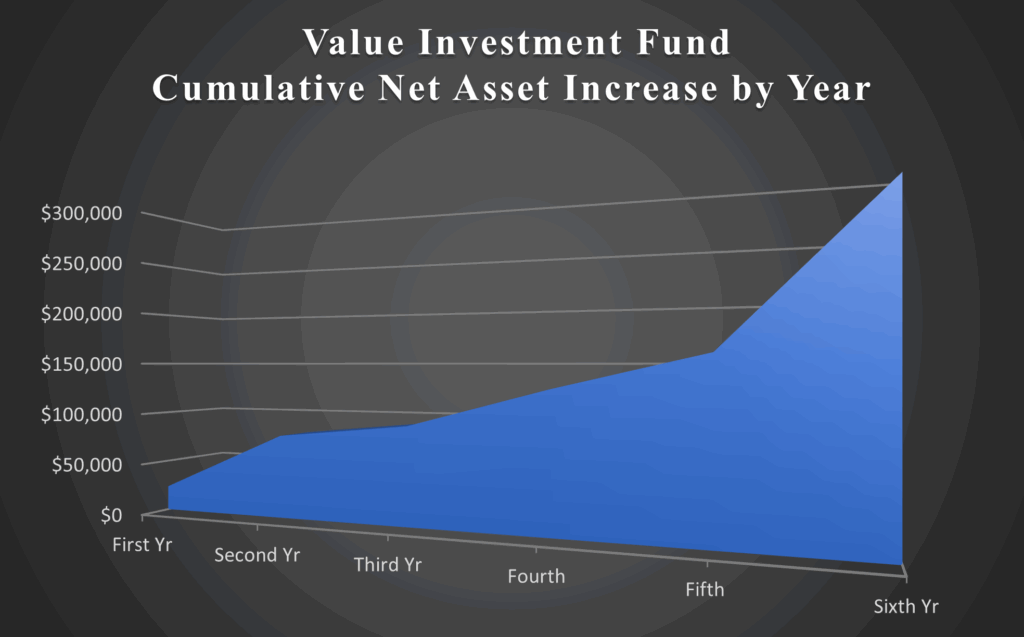

The Value Investment Fund now has six years of history behind it. For comparison, the Fund has achieved an annualized return of 25.9%. Below is a summarized report. The Facilitator is including a full set of details as downloadable PDFs. In addition, after the summary presentation, there are some interesting notes of activity throughout the six years of existence.

Six-Year Activity Report:

Net Realizable Gains from Security Activity $238,301

Earnings from Sale of PUT Options 42,303

Earnings from Dividends 21,405

Total Realized Earnings $302,009

Interest, Margin Acct Fees (9,437)

Income Taxes (85,942)

Net Realized Profit $206,630

The Value Investment Fund started with $100,000 on 10/01/19 as the initial basis (contribution). On 09/30/25, the Fund’s balance is as follows:

Cash $60,919

Dividend Receivable 514

Securities at Market Value 251,871 *Net of Tax Liability on Unrealized Gain

Total Net Assets $313,304

The existing securities have an unrealized profit of $9,270. To reconcile the $315,900 asset balance to the net realized profit of $206,630, follow this schedule:

Beginning Fund Balance $100,000

Realized Earnings Net of Interest & Margin Fees 292,572 *Realized $302,009 less $9,437

Unrealized Gains 9,270

Total Fund Balance for Comparative Purposes $401,842 *Comparative to Industry Indices (DOW, S&P 500, NASDAQ, Russell 2000)

Less Taxes (88,538) *Taxes Paid $85,942, Tax Accrual on Unrealized Gains = $2,596

Total Net Assets $313,304

For those readers interested in more details, please download this report: .

The following reports identify the detailed activity for the respective revenue streams over the last six years:

Some interesting activity notes from the last six years:

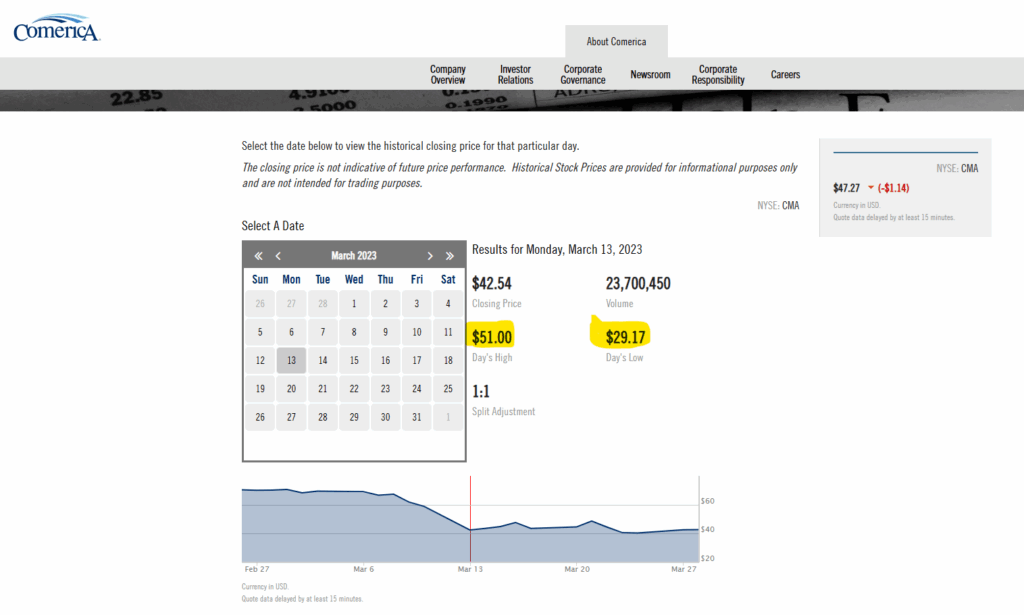

- The absolute best trade was a Comerica Bank buy/sell in a single day. In March of 2023, there was a banking crisis. One morning, Comerica’s stock price suddenly dropped to below $30 per share. The Fund had an automatic buy order at $30 per share. The facilitator received an email alerting him to this sudden change. Within two hours, the market price for Comerica recovered to greater than $50 per share. The Value Investment Fund sold at $50 and realized a net gain of $20,400 on 1,200 shares. This only occurred because the Value Investment Program utilizes pools of similar industry potential investments. The Banking Pool has certain standards and utilizes buy and sell points for each investment (you must be a member of the Club on this site to have access to this information), which in turn creates opportunities when an industry experiences sudden volatility, which happens in the banking industry every few years. See Lesson 14 about why value investors utilize pools to gain knowledge and act on that knowledge when opportunities present themselves.

- The best pool of investments that has generated the greatest aggregated return has been the Military Contractors Pool, returning more than $68k of realized gains, dividends, and the sale of PUT Options. Even more fascinating is that all of it has been off a single investment member within that pool. Here is another example of how knowledge of intrinsic value assists a value investor with setting buy and sell points. Patience with market changes allows for proper buying and selling of securities, which in turn generate quality returns with reduced risk exposure.

- In total, over six years, there as been thirty-six (36) full buy/sell transactions with stock securities. Value Investing is not a highly active, constant monitoring requirement. It is the exact opposite of Day Trading. This reduces anxiety with investments and the FOMO (Fear of Missing Out) commonly associated with all other trading mindsets. There are four principles of value investing that dramatically reduce tension and worry with one’s money. Throughout the entire six-year period, not one single investment lost money for the Fund. Application of the four principles greatly reduces fear and generates confidence with one’s investments.

There is not a single fund, investment mindset, or brokerage that can claim a 21% net annualized return after taxes. YES, someone can get lucky off speculation. But the risk of loss jumps dramatically, and at some point, the investor will lose with speculation. Value investing is at the other extreme, low risk, intrinsic value, and security analysis allows for patience to earn an outstanding annual return. It isn’t a get-rich-quick scheme; value investing is defined as a systematic process of purchasing high-quality stocks at an undervalued market price, quantified by intrinsic value and justified through financial analysis, then selling the stock promptly upon market price recovery. Act on Knowledge.