Industry Principles and Standards (Lesson 25)

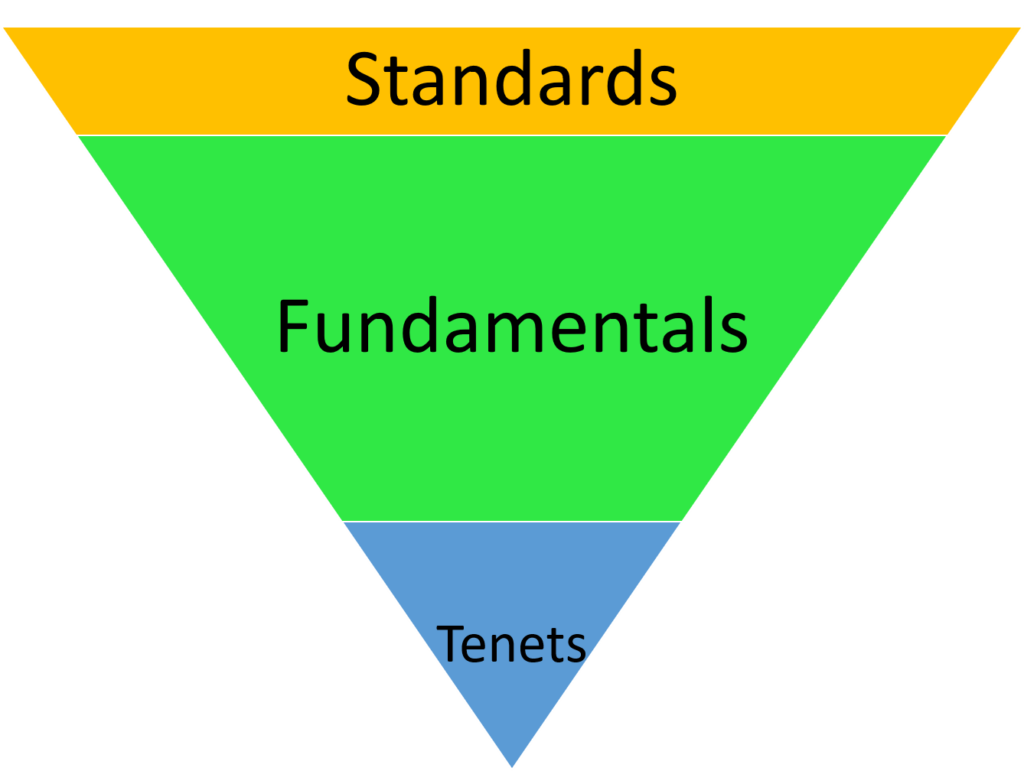

Shifting from economic wide factors that impact market price to industry wide standards is essential with understanding and creating decision models for investment with a pool of similar companies.

Industry Principles and Standards (Lesson 25) Read More »